PRIIP-RTS 2023: One standard - many challenges

29.04.2022

The recently adopted amendments to the regulatory technical standards (RTS) of the PRIIP Regulation (Packaged Retail and Insurance-based Investment Products) represent a major regulatory change for the financial industry.

As things stand, all players to whom the PRIIP Regulation already applies will have to implement the changes by July 1, 2022. For management companies, investment companies and persons advising on or selling units of undertakings for collective investment in transferable securities (UCITS), the exemption that expires at the end of 2021 has been extended until December 31, 2022.

This sometimes means fundamental changes and process-related adjustments for the providers of such financial products. The challenges lie in particular in the methodology and presentation of the performance scenarios, the presentation of costs and the methodology for calculating the total cost indicator. In addition, there are appropriate processes to ensure the accuracy, probity and clarity of this information.

Significant adjustments to the content

The PRIIP Regulation provides for the provision of a Key Information Document (KID) for packaged retail investment products and insurance investment products. While the KID is already prepared by many PRIIP manufacturers, it replaces the previously prepared Key Investor Information Document (KIID) for UCITS. The KID differs significantly from the KIID in terms of content, structure and scope. From the KIID, the information on past performance for UCITS funds and alternative investment funds is retained. However, this information is to be provided via a reference outside the KID on a website or in a separate document.

Increased complexity in calculations of ratios

As before, the RTS classify PRIIPs into four categories and require disclosure of four performance scenarios and the Summary Risk Indicator (SRI). Depending on the category, different calculation models are specified, such as the bootstrap Monte Carlo simulation, possibly with upstream principal component analysis, the Cornish-Fisher extension and other methods.

The most extensive changes were made to the calculation method of the performance scenarios for category 2 financial instruments. Previously, these were determined using a calculation method similar to the SRI method. Now, the latest amendment to the RTS calls for a new and significantly more elaborate calculation model for three performance scenarios (optimistic, moderate, pessimistic); the stress scenario, on the other hand, continues to be based on the previous calculation method.

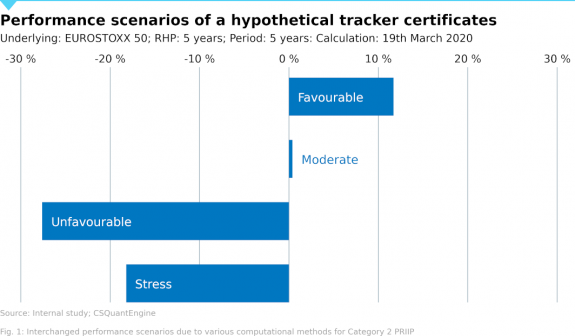

The legislator anticipates possible inconsistencies due to the different calculation methods within this category by stipulating that the annualized return of the stress scenario may never be better than that of the pessimistic scenario. The fact that this issue is relevant in practice is shown by the calculation in Fig. 1.

In addition, the historical price data required to calculate the performance scenarios was increased to the recommended holding period plus 5 years, but at least 10 years. It is true that insufficient history can be completed with a suitable benchmark (comparative index) or proxy (proxy financial instrument) as before. However, the challenges regarding data procurement increase in any case.

The addition of the so-called minimum investment return as a supplement to the performance scenarios is completely new. Here, the RTS require the presentation of the guaranteed minimum return; whereby the guarantee term should not be interpreted in the narrow sense. Rather, it includes the product-specific determination of all unconditional claims of the PRIIP investor, such as unconditional coupons.

There are also noteworthy requirements regarding the calculation of transaction costs with regard to a transitional arrangement for UCITS funds and AIFs. Until the end of 2024, there is a choice between the so-called New PRIIP and the Arrival Price Method. However, it is advantageous to waive this option and to apply the arrival price method already now in order to start building up the required three-year history already. This will prevent inconsistencies in the reporting of transaction costs due to the change in method on January 1, 2025.

More stringent data management requirements

In order to ensure the accuracy, probity and clarity of the information in the KID, the regulations already provide for regular audits. In the event of sufficiently significant changes, the KID must be updated. The new requirements mentioned above demand at least the modification of existing processes, but more likely the establishment of new ones, and place additional demands on data acquisition, processing and storage.

Without specialized systems, the required processes are almost impossible to map simply because of the variety of possible changes. For example, a change in investment strategy, a significant change in SRI within a four-month period, or a deviation of more than 5 percentage points in the average return for the median performance scenario requires the creation of a new KID.

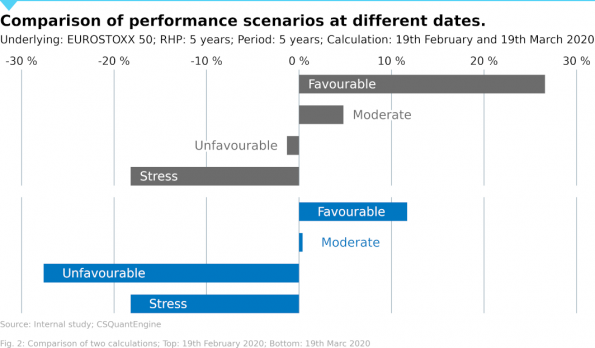

In addition, there are quality assurance measures required for regulatory compliance. This is illustrated by Fig. 2, which picks up on the facts of the switched scenarios presented above. There is only one month between the two calculations. This illustrates that the quality of the calculation results can change at very short notice.

All players who are involved in mandatory regulatory documentation will be faced with major challenges at all stages of the provision process caused by the adjustments to the PRIIP RTS 2023 outlined above.

In particular, it is apparent that the aforementioned changes sometimes require high computing power due to their complexity. In addition, due to the nature of the process, these are not required continuously, but only on each trading day and in a short time window. Classical IT systems are challenging here - not only, but mainly - due to high investment and operating costs, especially for cost-sensitive PRIIP manufacturers, so that modern cloud solutions offer themselves.

In terms of documentation requirements, the KID is just another document in a series of other (mandatory) documents required for PRIIP distribution. Common to all documents are the similar requirements for data, processes and quality assurance, so it makes sense for financial market players to look at the creation process from a holistic perspective and map it in a document management system.

Author: Marcus Klein, Managing Director Marketing and Sales at Content Software and responsible contact person for software solutions and services in investment research and regulatory documentation. © Content Software

The original article (published on 14.04.2022) can be found in: gi Geldinstitute